How much can you normally borrow for a mortgage

That is to say if your dream home is valued at 200000 euros the. By law 401k loans are limited to 50000 or 50 of your account balance whichever is less within a 12-month period.

250k Mortgage Mortgage On 250k Bundle

Home equity loans usually arent the answer if you only need a small infusion of cash.

. Our experienced loan experts will help you determine how much house you can afford and check if you qualify for one of our zero-down loans with no private mortgage insurance PMI. This provides you a ballpark estimate of how much you can borrow from a lender. Remember your borrowing power is only an indication of how much you can borrow.

How much can you borrow from your 401k. Funds are normally received very quickly. If you cant save enough some mortgages let you apply with a guarantor instead of a deposit.

This is for lenders to check how much the property youre buying is worth. We also offer a 500 rebate on your closing costs Learn more about First-Time Home Buyer Loans. Homeowner Tax Deductions.

There are up to 200000 so-called mortgage prisoners trapped in their current mortgage deal. Westpac will normally lend up to 80 of a standard residential propertys value. With a mortgage from first financial youre golden.

Loan repaid through normal 401k contributions. 51 How much can the bank lend you for your mortgage. Data received as part of initial enquiries is normally kept for two years before being deleted.

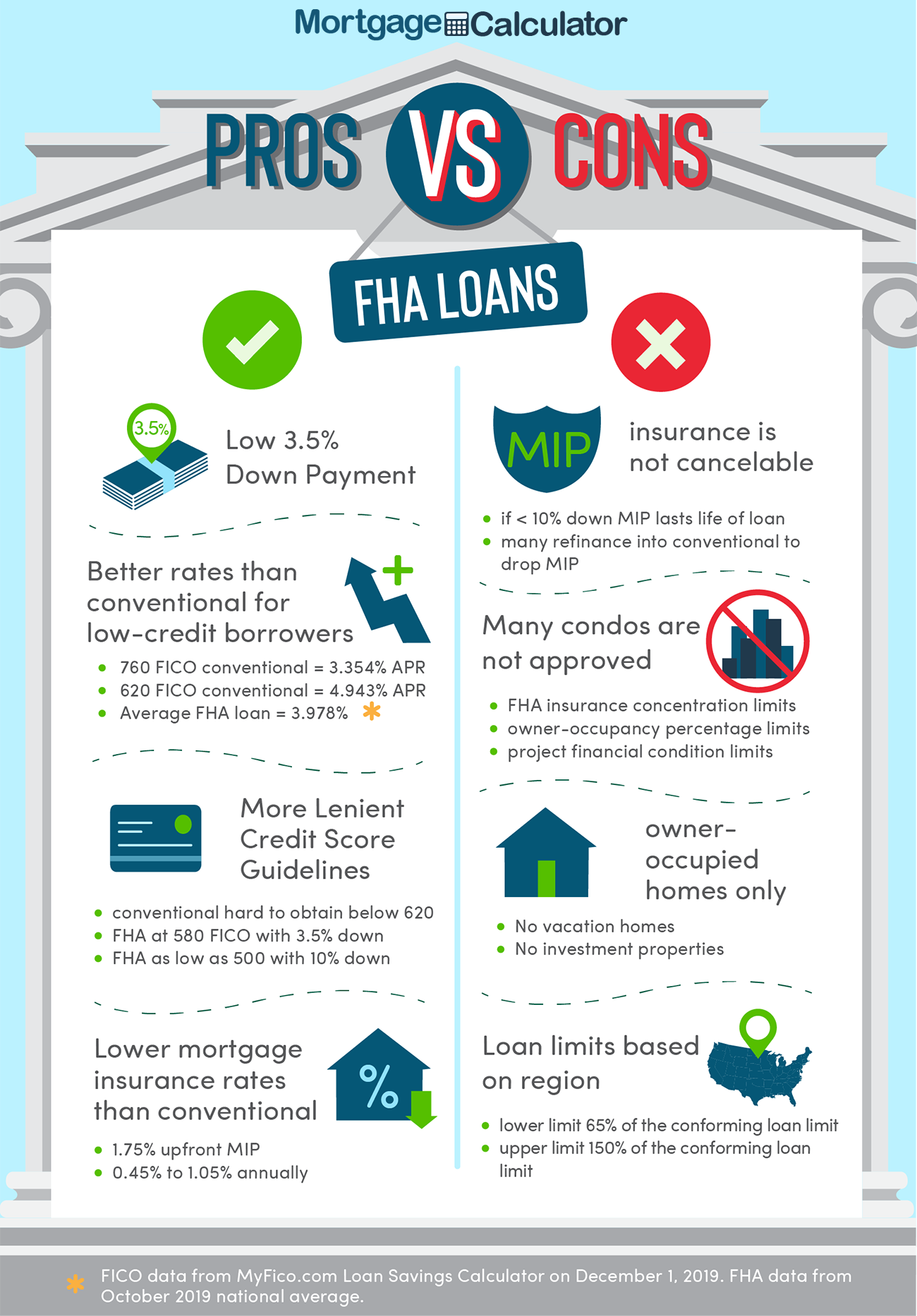

The Federal Reserve designs and implements policies to keep inflation and interest rates relatively low and stable. Your home value has increased considerably. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018.

Borrowers can get preapproval from the company in as little as three minutes. The cost of borrowing for a mortgage in Portugal is normally less than the cost applicable to an. They work great if you already have a low-interest mortgage and dont want to.

Once youre ready to go you can start the actual work of buying a house with these key steps. Currently most SVRs are around 45 to 5. You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan.

It may be a good idea to get preapproved for a mortgage and get a conditional letter of approval from your lender that explains how much you can borrow. For example if your salary is 25000 you could borrow a maximum of 100000. Residents can generally borrow up to 80 of the propertys assessed value whereas non-residents are limited to 6070 LTV.

In the UK usually the longest term fixed mortgage you could normally get was five years. If you cant. In the US the Federal government created several programs or government sponsored.

Better Mortgage NMLS 330511 offers an online mortgage lending program in all states except Nevada. The biggest one will likely be the mortgage arrangement fee which can set you back up to 2000 in some cases and you might have to pay booking and broker fees too. Before you can obtain a mortgage you must undergo a qualification process.

To give you an idea of how much fees can add up before closing the appraisal on a single-family home can range from 313 to 420 according to HomeAdvisor. Fannie Mae HomePath. How Much Can You Afford to Borrow.

The usual way to determine how much you can borrow with a mortgage would be to multiply your income by four. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. This mortgage finances the entire propertys cost which makes an appealing option.

A modest rate of inflation will usually lead to low interest rates while concerns about rising inflation normally result in increased interest rates. If you miss your mortgage payments your guarantor has to cover them. Theres also the option for a construction mortgage.

You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. The mortgage pre-qualifying process is an informal assessment of your ability to repay a loan. SVRs are the rates paid when your normal mortgage term runs out and are normally 3-6 higher than standard home loan rates.

The entity to which you ask for the loan will not normally lend you 100 of its value. You can usually borrow 50 to 60 of the combined costs of the land and construction however these mortgages are complex and specialist advice from a mortgage broker is advisable. Saving a bigger deposit.

With help from your real estate agent set a reasonable sale price for your home. Of course thats not to say that a high-income earner would want to put say 50 of their income towards housing costs especially when income can change over the life of a 25-year loan. Lenders generally prefer borrowers that offer a significant deposit.

Set a sale price. Budget for 300 to 400 though sometimes it can be free. It also gives you an overall picture of whether you satisfy minimum requirements for a mortgage.

Though some lenders will extend loans for 10000 many wont give you one for less than 35000. Buying your first home with confidence. However as a drawback expect it to come with a much higher interest rate.

Your Guide To 2015 US. Note that your mortgage lender cant tell you who you can or cannot sell to but they are allowed to ask for a buyers pre-approval or proof of funds. If you do borrow more you could end up with two loans.

If you do proceed with a full application for a mortgage protection or other product your personal data will be retained for longer. When to consider a refinance of your reverse mortgage. You might need this letter when it comes time to make an offer.

They typically request at least 5 deposit based on the value of the property. Including when you remortgage to a new lender as the new provider pays off the debt on the old deal you normally pay an exit fee which is usually a few hundred pounds. With Lenders Mortgage Insurance Westpac can lend up to 95 of a standard residential propertys value 90 of a vacant block of lands value.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. A title search can run from 150 to 500. If a house is valued at 180000 a lender would expect a 9000.

By using our mortgage calculators we can help you understand key things like how much you can borrow.

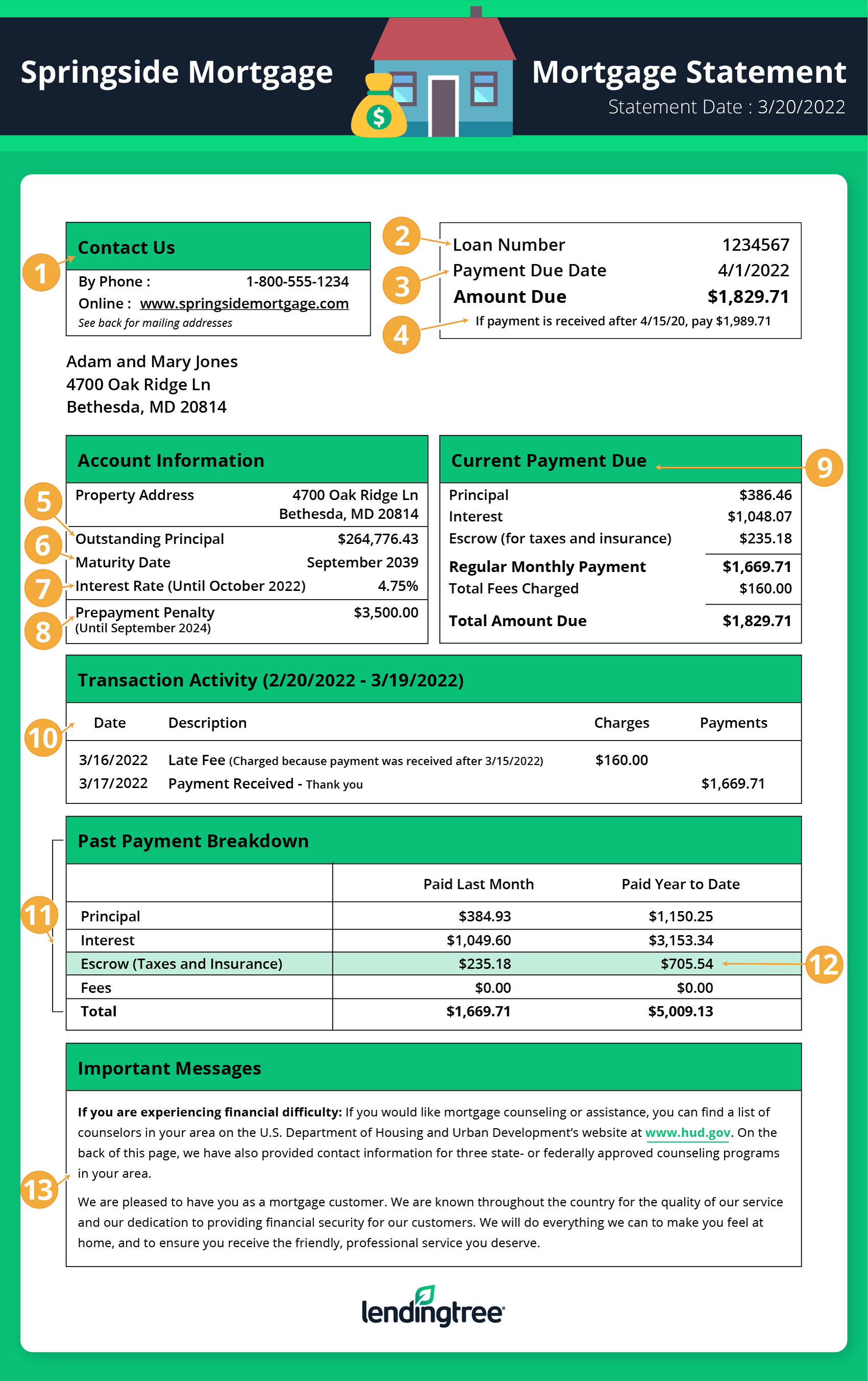

How To Read A Monthly Mortgage Statement Lendingtree

Mortgage Points A Complete Guide Rocket Mortgage

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Looking To Buy A House Soon Here S A Checklist To Make Sure You Don T Miss Out On Anything Before Y Home Buying Checklist Home Buying Check Your Credit Score

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

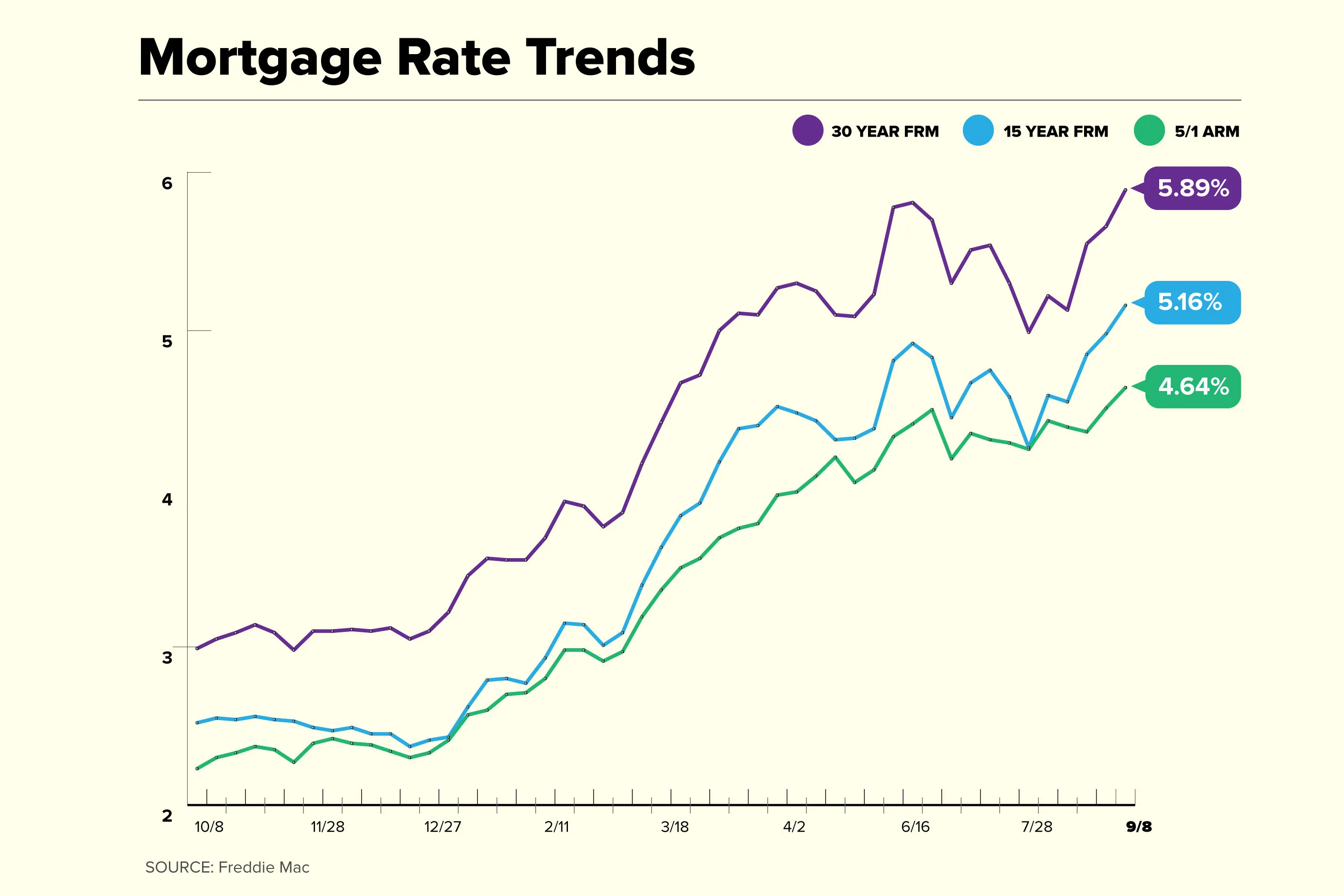

Current Mortgage Interest Rates September 2022

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Agbo5fvxuoyi1m

What Is 100 Mortgage Financing And How To Get It

Pin On Real Estate

What Is 100 Mortgage Financing And How To Get It

I Make 75 000 A Year How Much House Can I Afford Bundle

Money Tribune Income Tax Deduction For Home Loan Under Section 24 80c And 80ee Buying A Home Is A Costing Affair For Any Investing Income Tax Tax Deductions

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

What Is A Mortgage

How Much A 450 000 Mortgage Will Cost You Credible